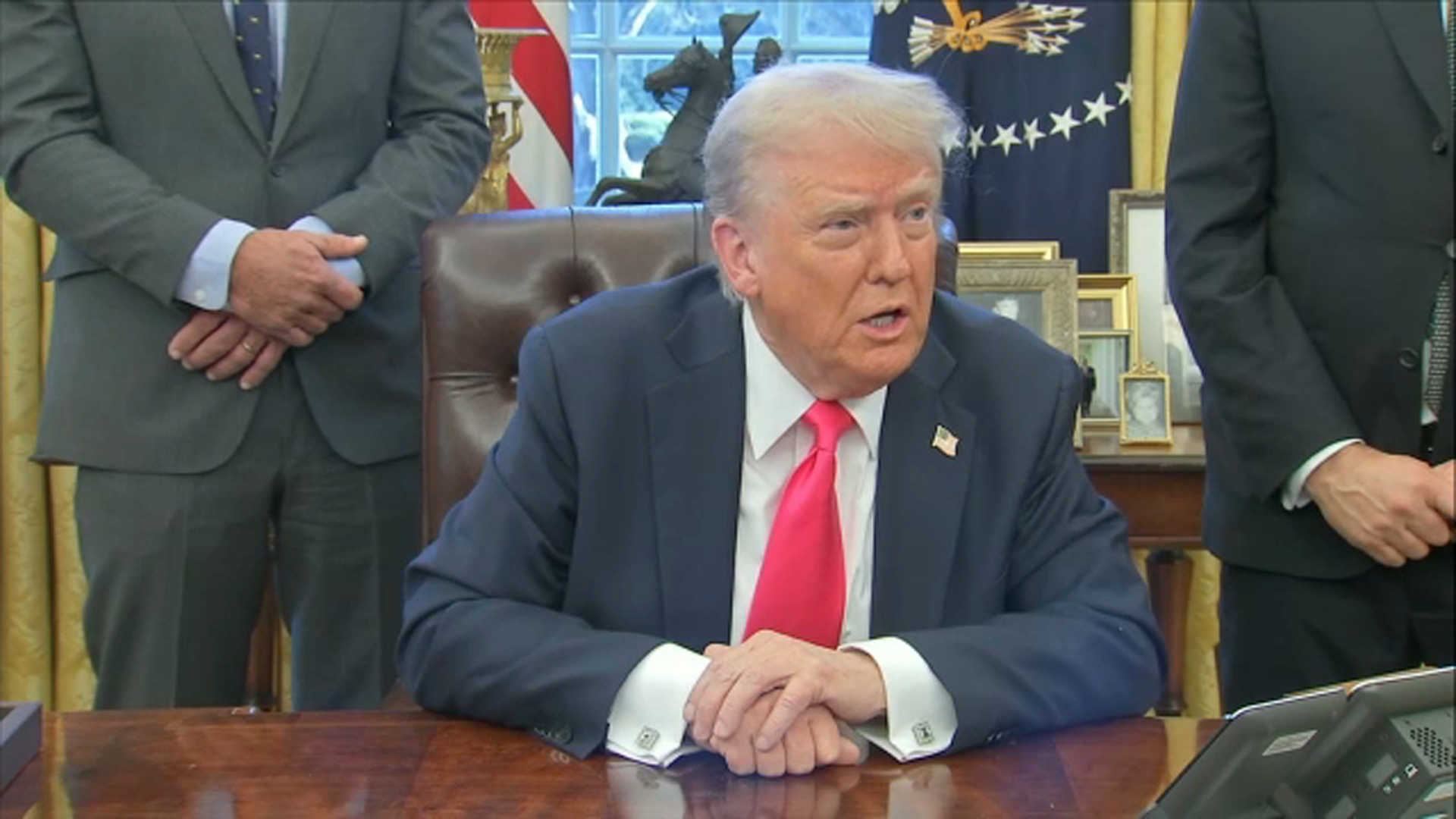

President Donald Trump faces a choice ahead of a Feb. 1 target date for his tariffs to begin kicking in: revenue or revenge?

He campaigned on a blanket tariff that would generate revenue and help protect American workers. But since he was elected, Trump has toyed with country-specific tariffs as a negotiating tactic or punitive measure.

Trump has talked about using tariffs as a way to offset some of the revenue that would be lost by extending and expanding his 2017 tax cuts. He added tariffs on pharmaceuticals, computer chips and metals such as copper, steel and aluminum to his list on Monday, which he said could help pay for another tax cut for domestic manufacturers and bring industrial jobs back to the United States.

But he also has threatened to impose tariffs as a form of punishment for countries he views as uncooperative − which means forgoing the duties if they do concede to his demands. That includes tariffs on goods from China, Mexico and Canada, unless they clamp down on fentanyl trafficking and illegal immigration.

“We’re going to protect our country with tariffs,” Trump told Republican lawmakers in a speech. “If they don’t make their product in America, then very simply, they should have to pay a tariff, which will bring in trillions of dollars into our treasury,” he added, referring to foreign manufacturers.

Trump allies say he may ultimately go with some combination of the ideas he’s floating or a tariff strategy that wraps in all of the above.

“Punish our enemies, use tariffs as a bargaining chip and use tariffs as a revenue-raising measure to offset the reduction in the income taxes that we want to do,” said Stephen Moore, a senior economic adviser for Trump’s campaign and a fellow at the conservative Heritage Foundation, of the thinking inside the White House.

Some experts say that approach could cause problems down the line. Tariffs that countries can wriggle out of through policy concessions are not a stable revenue source, and what if other nations follow through on threats to introduce retaliatory tariffs?

Tariffs that are primarily used as a negotiating tool to drive national security policy, “can be immensely effective,” said Maya MacGuineas, president of the bipartisan Committee for a Responsible Federal Budget.

“But if that’s how they’re used, it will undermine their positive effects on fiscal policy, because it is never clear how long they will be in place,” MacGuineas said. “If you want to offset permanent tax cuts, there’d have to be a commitment that the tariffs will be permanent, and that seems highly unlikely.”

The president could wind up with less revenue than he’s expecting and send costs soaring for Americans, experts and economists say. Even the threat of tariffs can create uncertainty in the markets, slow trade and damage America’s relationships with its allies.